Filed under: Affordable Care Act, Combs & Company, Combs & Company Blog, HR, Important Notice, Obamacare, Reform, Susan L Combs | Tags: ACA, Combs & Company, Insurance Terms, National Healthcare, Penalties

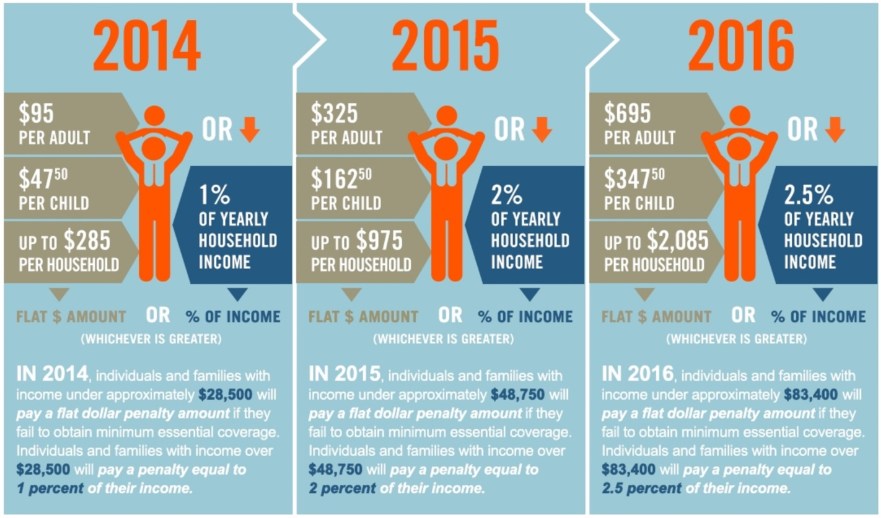

So we are in the home stretch! Three more days to go and then Open Enrollment ends for 2016. From experience, I have learned that many people wait until the last minute to pick a plan and some people just continue to bury their heads in the sand. So for those of you that are wondering, how much it’s going to cost you if you don’t get your act together, take a look at this user friendly graphic that will show you what to expect!

Filed under: Administrative Fix, Affordable Care Act, NAHU, National Healthcare, Obamacare, PPACA, Reform | Tags: 1094, 1095, 6055, 6056, ACA, Employer Requirment, Insurance Terms, NAHU, National Healthcare

This morning, the Internal Revenue Service (IRS) made an announcement that may affect your clients regarding compliance to new Affordable Care Act (ACA) mandated coverage reports (6055 and 6056) for 2015. The IRS announced that it is giving employers additional time to file certain reports. In Notice 2016-4, the IRS stated that it is delaying filing deadlines after determining that “additional time to adapt and implement systems to gather, analyze, and report this information” was needed by employers, insurers, and other providers.

This morning, the Internal Revenue Service (IRS) made an announcement that may affect your clients regarding compliance to new Affordable Care Act (ACA) mandated coverage reports (6055 and 6056) for 2015. The IRS announced that it is giving employers additional time to file certain reports. In Notice 2016-4, the IRS stated that it is delaying filing deadlines after determining that “additional time to adapt and implement systems to gather, analyze, and report this information” was needed by employers, insurers, and other providers.

The deadline for employers to electronically file 1094 forms for 2015 was extended by three months from March 31, 2016, to June 30, 2016. The deadline for filing by paper was also extended by three months from February 29, 2016, to May 31, 2016. Additionally, the deadline for providing employees with 1095 forms for 2015 was extended from February 1, 2016, to March 31, 2016.

Click here for today’s IRS announcement or for background about the mandated ACA coverage reports.

Filed under: Uncategorized | Tags: ACA, Broker Motivation, National Healthcare

I’m not sure about you, but for open enrollment this year I averaged between 65 to 70 hours per week. It was a nice reduction from last year’s 80-hour weeks!

But one thing I’m struggling with right now is that after all the chaos and hustle and bustle of December, January has got me off to a little bit of a deflated start.

This “Blue January,” as I’m calling it, doesn’t seem to be affecting just me. I’ve talked to several other brokers who are feeling it, too. We absolutely killed ourselves over the past couple of months, and it seems as though the sense of urgency and the sheer panic in the voices of clients calling to get coverage have fallen away. Click Here for More!

Filed under: Health Insurance, National Healthcare, Reform | Tags: Individual Health Insurance, National Healthcare, NY Healthcare Costs

We have been getting numerous emails with this article being referenced by our clients along with excitement that when they wake up on January 1st, 2014 that their insurance bills will now be cut in half. I would like to draw your attention to a few items in this article and give you a bit of a reality check.

Point 1: “Individuals buying on their own will see their premiums tumble next year in New York State as changes under the take effect, Gov. Andrew M. Cuomo announced on Wednesday.” The first thing that Groups need to look at is the first word….”Individuals”, this is not talking about Group Insurance, this is talking about the Individual Market in New York State that has been extremely expensive in the past. For example, one carrier that currently has an Individual Plan, the rates are coming in around $2000 per month for an Individual. Even with a 50% reduction, that is a $1000 premium for an Individual, which is still well over the average rate under Group Coverage in the State of New York.

Point 2: “Beginning in October, individuals in New York City who now pay $1,000 a month or more for coverage will be able to shop for health insurance for as little as $308 monthly.” I believe that this is very misleading, this is giving you the lowest price that is going to be in the Exchange aka Marketplace without a Subsidy (tax credit for being under 400% of the Federal Poverty Level). This price references what is being called “Young Invincible” Plan meaning, that to get this plan, you must be under 30 years old and you are looking at having more of a catastrophic plan which would cover Preventative Care and then you would have a minimum of a $6000 Deductible before anything else would be covered. Currently, New York does not offer any plans with this type of watered down coverage.

Point 3: “With federal subsidies, the cost will be even lower. (than $308 monthly)”. This will be ONLY if you as an Individual qualify for a Subsidy. This means that as a single person, to get ANY type of price break in the Exchange / Marketplace you must make under 400% of the Federal Poverty Level, which translates into making under $45,960 annually. If you do not make under that, then the plans you can get in the Exchange / Marketplace are going to be the exact same costs that you can get outside the Exchange / Marketplace

Things we are excited about in this article:

1. That for Individuals that have struggled with the high cost of health insurance will get to see some relief.

2. Department of Financial Services say they have approved 17 insurers to sell individual coverage through the New York exchange, including eight that are just entering the state’s commercial market. Currently there are only a handful, so more choices will be better for everyone! Keep in mind some of these may just be Medicare networks that only the lower income individuals will qualify to be a part of.

What else to keep in mind:

1. Be looking for “Borough-centric” plans, meaning that carriers are going to come out with plans that limit the network dramatically in order to get the cost down. A great example of this has been with Aetna’s NYC Community Plan, these plans have typically been under $400 a month in premium but they are an HMO plan where you must get a referral and they only have doctors in the 5 Boroughs. The smaller NYC Community Network they are utilizing is about 40% of the size of the normal Aetna Network. So be looking for these type of plans to be coming out In and Out of the Exchange / Marketplace.

2. Brokers will be allowed to sell inside and outside of the exchange and there will be no difference in cost. Be weary of signing up through a Navigator because as it stands right now, they are going to be glorified Enrollers that since they are not licensed, they cannot advise on Insurance, they can only present to you the plans and have you draw your own conclusions. Also, 6 months down the road if you have a question about the benefits you bought or you are having a claims issue, you cannot go back to the Navigator, you’ll be dealing with the carrier directly and not have someone as your advocate as you would if you had got your plan through a Licensed Broker that is more qualified to help assist you with your needs.

3. Be on the look out as groups to be getting hit with more taxes on your group plans, this is going to help to pay for the cost reduction for the Individual Plans.

Filed under: Medicaid Expansion, National Healthcare | Tags: Medicaid Expansion, National Healthcare, What does Medicaid Expansion mean for employers

Medicaid Expansion

Medicaid is a partnership between the federal government and the states. States are able to design their own programs within the boundaries set by federal regulations and the federal government ponies up a large share of the money. The current Medicaid program requires states to cover only certain categories of needy individuals: pregnant women, children, needy families, the blind, the elderly and the disabled. Today, approximately 60 million people are enrolled in the program; expansion would add another 17 million. The ACA’s Medicaid expansion provisions require states to expand their Medicaid programs by 2014 to cover all individuals under the age of 65 with incomes below 133% of the federal poverty level (roughly $31,000 for a family of four). The ACA offered expansion of Medicaid on very generous terms – the law calls for the federal government to pick up all costs of the Medicaid expansion from 2014 through 2016. Subsequently, the federal payment level gradually decreases, to a minimum of 90%.

The challenge to the ACA was that it unconstitutionally coerced states to expand Medicaid by threatening to withhold all federal Medicaid grants for non-compliance. Instead of just refusing to grant new funds to states that did not comply with the new conditions, it would withhold those states’ existing Medicaid funds. The counter argument was that the Medicaid expansion provisions were simply modifications of the existing program that offered financial inducements to comply with the new law. The Supreme Court held that, while states could be required to comply with certain conditions in order to receive funds, they could not be penalized if they chose not.to participate in the new program by taking away their existing Medicaid funding. Simply put, the Court found that the ACA provisions were unconstitutional because the government cannot coerce states to expand Medicaid by threatening to withhold existing federal Medicaid funds. Additionally, the Court further found that the unconstitutional provisions could be severed and remedied, leaving the rest of the statute intact. The end result is that states may decide to opt out of the Medicaid expansion.

States that choose not to participate in the expansion will be faced with questions about how Medicaid programs will function and how it will affect the population that would have been Medicaid eligible through the expanded coverage. Opting out of the expansion would save the states some money in the long run. Within hours of the Supreme Court’s decision, Republican officials in several states said they were likely to oppose expanding the program.

What does this mean for employers?

For employers with above 50 lives, this could mean additional penalties under the ACA. If a state doesn’t expand Medicaid coverage, employers with over 50 lives may be subject to more plan affordability penalties than they would be were the state to expand. Under the employer mandate, employers are subject to penalties if they fail to offer group health plan coverage or they offer coverage that fails to meet certain quality and affordability standards (generally if premium for single coverage exceeds 9.5% of employee’s household income or if the plan fails to provide at least a 60% “actuarial value” and the individual enrolls in the Exchange). If Medicaid coverage is not expanded, individuals who would have been eligible for Medicaid under the expanded conditions will now likely find coverage under an Exchange and be eligible for federal subsidies. This could increase an employer’s exposure to shared responsibility under the employer mandate.

Employers with less than 50 lives and not subject to the employer mandate will also be affected. States that choose not to expand Medicaid will force more people to be dependent upon their employers or an Exchange for health insurance. Coverage under the Exchange will be challenging to navigate at the onset, will vary state by state, and may or may not be a viable option for many employees, effectively forcing the employer to step in. When employees cannot afford their insurance, it tends to leave employers in a sticky situation.

No matter what the size of an employer, allowing states to opt out of the Medicaid expansion provisions will likely result in more people (who typically were not insured in the past) seeking coverage on an Exchange. This certainly does not bode well for the overall experience of the Exchange-based plans, ultimately affecting rates and affordability for employees.

___

This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional. ©2012 Emerson Reid, LLC. All Rights Reserved.

Filed under: National Healthcare | Tags: ACA, Healthcare Ruling, National Healthcare, supreme court, Supreme Court Decision

US Supreme Court Upholds Affordable Care Act

The US Supreme Court today (June 28, 2012) upheld the Affordable Care Act (ACA), ruling that the law’s individual mandate is a constitutional exercise of Congress’s power to impose taxes. With the Court’s decision, compliance efforts likely will move ahead at full speed with major provisions of the ACA becoming effective in 2013 and 2014.

In a 5-4 decision, Chief Justice Roberts, joined by Justices Ginsberg, Breyer, Sotomayor and Kagan, concluded, “The Affordable Care Act’s requirement that certain individuals pay a financial penalty for not obtaining health insurance may reasonably be characterized as a tax. Because the Constitution permits such a tax, it is not our role to forbid it, or to pass upon its wisdom or fairness.”

In the Court’s analysis of the ACA’s Medicaid provisions, it held that it would be unconstitutional for the federal government to withhold all Medicaid funding in order to force states to comply with the Medicaid expansion. Chief Justice Roberts wrote, “Nothing … precludes Congress from offering funds under the ACA to expand the availability of health care, and requiring that states accepting such funds comply with the conditions on their use. What Congress is not free to do is to penalize States that choose not to participate in that new program by taking away their existing Medicaid funding.”

The Court ruled that the Anti-Injunction Act, which limits lawsuits challenging a tax before it is assessed, does not apply because Congress specifically provided that the penalty payment enforcing the individual mandate would not be treated as a “tax.” Notwithstanding acceptance of Congress’s penalty label for purposes of application of the Anti-Injunction Act, the Court ruled that for purposes of determining whether the individual mandate is constitutional, the penalty payment falls within Congress’s general power to tax and, therefore, is upheld.

The decision arises from cases brought by the state of Florida (and joined by 25 other states), the National Federation of Independent Business, and several individuals challenging the constitutionality of the individual mandate and the Medicaid expansion. The cases were later consolidated.

In their dissent, Justices Kennedy, Scalia, Thomas and Alito wrote that the law should have been struck down in its entirety.

With the exception of the limitation on the federal government’s authority to withhold Medicaid funding, all provisions of the ACA stand and compliance efforts likely will move ahead at full speed. In preparation for the major coverage expansion to occur under the ACA in 2014, the Administration is expected to release a host of regulations dealing with the definition of minimum essential coverage, employer coverage and reporting requirements, and an array of new taxes and fees. Clients should be aware of provisions of the law set to take effect in 2013 and 2014, including those listed in the table below.

Provisions of the Affordable Care Act That Take Effect in 2012, 2013 and 2014

2012

• Medicare hospital value-based purchasing program

• Increase in physician quality reporting requirements in Medicare

• Additional Medicare pilot programs on alternative payment methodologies, e.g., accountable care organizations

• Increased requirements for hospitals to maintain not-for-profit status

• Fees from insured (including self-insured) plans transferred to the Patient-Centered Outcomes Research Trust Fund

2013

• Increase Medicare payroll tax by 0.9% on high-income earners

• Impose a 3.8% tax on net investment income of high-income individuals

• $500,000 cap on health insurers’ deduction for executive compensation

• Eliminate employer deduction for Medicare Part D subsidy

• FSA limitations

• Excise tax on medical device manufacturers and importers

• Medical expense deduction floor increases to 10%

• Nationwide bundled payment pilot begins in Medicare

• Increased Medicaid reimbursement for primary care

• Medicare physician comparison data available to the public

• Reductions in Medicare payments for select hospital readmissions

• Expanded coverage of preventive services by Medicaid

2014

• Employer mandate and individual mandate

• Employer and insurer reporting requirements

• New health insurance market reforms take effect

• State health insurance Exchanges established

• Premium tax credits and cost-sharing subsidies available to certain individuals in Exchange insurance products

• Medicaid expansion to new populations (100% federal match to states for newly-eligible populations through 2016)

• Annual fee on health insurers

• Medicare/Medicaid DSH payment cuts begin

• Independent Payment Advisory Board (IPAB) issues first report to Congress if Medicare spending exceeds growth target

Post-2014

• Excise tax on high-cost employer-sponsored coverage (2018)

Political reactions

The Court’s ruling will not end the political debate over health care, which will remain a central issue in the 2012 elections and beyond. The law stands as the centerpiece of the domestic record of President Obama, who today said, “Whatever the politics, today’s decision was a victory for people all over this country whose lives will be more secure because of this law and the Supreme Court’s decision to uphold it.” The President added, “With today’s announcement it is time for us to move forward to implement and, where necessary, to improve this law.”

In comments in response to the ruling, presumed Republican presidential nominee Gov. Mitt Romney said, “What the Supreme Court did not do on its last day in session, I will do in my first day in office. I will act to repeal Obamacare.”

Following the release of the decision, House Majority Leader Eric Cantor (R-VA) announced that the House on July 11 will hold a vote on legislation to repeal the ACA in its entirety. The measure likely will pass the Republican-controlled House, but it is unlikely to advance in the Democratic-controlled Senate.

Repeal of the ACA has been a primary focus of congressional Republicans and remains a central objective of many Republicans’ campaigns in the November elections. Efforts to repeal all or part of the law will remain difficult unless Republicans maintain control of the House, win the presidency, and win at least a majority in the Senate in the November 2012 elections.

Republicans to date have not coalesced around a proposal to replace the ACA. Further efforts to control rising health care costs, including reforms to federal health entitlement programs and health-related tax expenditures, will be at the center of budget and deficit-reduction debates that are expected to dominate Washington after the November elections.

Background on the law

The Affordable Care Act was enacted in March 2010; it comprises the Patient Protection and Affordable Care Act of 2010 (which President Obama signed on March 23, 2010) and the Health Care and Education Reconciliation Act of 2010 (which the President signed on March 30, 2010).

The primary goals of the ACA are to: (i) expand coverage to an estimated 32 million Americans without health insurance; (ii) reform the delivery system to improve quality and drive efficiency; and (iii) lower the overall costs of providing health care.

To accomplish the goal of expanding coverage, the ACA mandates that all Americans maintain a minimum level of health coverage (the so-called individual mandate) or face a tax penalty. The law expands Medicaid coverage and provides federal premium tax credits and cost-sharing subsidies to assist low and moderate income individuals without affordable employer-sponsored insurance in obtaining health insurance through state-based insurance Exchanges. The ACA mandates, for the first time, that employers with 50 or more full-time employees provide certain minimum benefits or pay penalty fees.

The law also implemented insurance market reforms, including a ban on exclusions for pre-existing conditions, premium rate restrictions, extension of dependent coverage through age 26, and mandatory coverage of preventive services.

A mix of Medicare and Medicaid reimbursement cuts; provisions to reduce fraud, waste, and abuse in those public programs; other delivery system reforms; and a series of tax increases on individuals, corporations and the health industry are used to offset the cost of the law.

For more information

A video highlighting key elements of the Supreme Court’s decision will be available on www.ey.com.

An Ernst & Young Thought Center webcast discussing the ruling’s implications for individuals, employers, and health care providers has been scheduled for July 17. Follow this link to register.

Filed under: National Healthcare | Tags: Employer Requirment, National Healthcare, SBC, Summary of Benefits & Coverage

The Affordable Care Act (ACA) requires all group health plans, including grandfathered plans and self-insured plans, to provide participants and beneficiaries a summary of benefits and coverage (SBC). The effective date for compliance with the SBC requirements under the ACA was delayed pending further guidance (proposed regulations had been issued in August 2011). The Departments of Labor, Treasury and Health and Human Services (the Departments) issued final rules regarding these provisions which will take effect beginning in September 2012.

Who Must Provide an SBC?

For fully-insured plans, both the carrier and the plan administrator (typically the employer) are responsible for providing the SBC to participants and beneficiaries. The final regulations provide that as long as either one of them provides a complete SBC in a timely manner, the requirement will be deemed satisfied for the other party. Employers should reach out to their carriers to discuss who will take on this responsibility. For self-insured plans, the plan administrator is responsible to provide the SBC and employers should contact their third-party administrator for assistance. The final regulations clarify that a single SBC may be provided to a participant and any beneficiaries at the participant’s last known address. If a beneficiary’s last known address is different than the participant’s, a separate SBC must be furnished to such address.

What is Required to be in the SBC?

- The following information must be included in the SBC:

- Uniform definition of standard insurance terms and medical terms;

- Description of the coverage, including cost sharing for each category of benefits;

- Exceptions, reductions and limitations of coverage;

- Cost sharing provisions including deductibles, coinsurance and copay obligations;

- Renewability and continuation of coverage provisions;

- Coverage examples;

- Statement that the SBC is only a summary and that the plan document, policy or certificate of insurance should be consulted;

- Contact information for questions and to obtain the plan document, policy or certificate of insurance;

- Internet address to obtain a list of network providers;

- If the plan has a prescription drug formulary, an internet address to obtain information on prescription drug coverage; and

- Internet address to review the uniform glossary, and a statement that paper copies are available, as well as contact information for how to get them.

Helpful Links

Compliance Guide: www.dol.gov/ebsa/pdf/SBCguidance.pdf

Summary of Benefits and Coverage Template: www.dol.gov/ebsa/pdf/SBCtemplate.pdf

Instructions for Completing the SBC – Group Plans: www.dol.gov/ebsa/pdf/SBCInstructionsGroup.pdf

Uniform Glossary of Coverage and Medical Terms: www.dol.gov/ebsa/pdf/SBCUniformGlossary.pdf